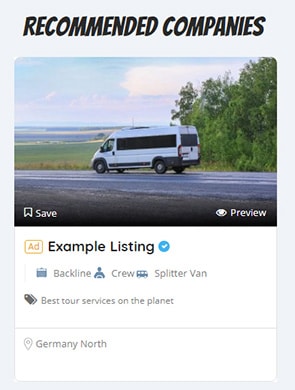

Spotlight

Your listing will appear randomly on the home page under „Recommended Companies“ and in the sidebar of the blog.

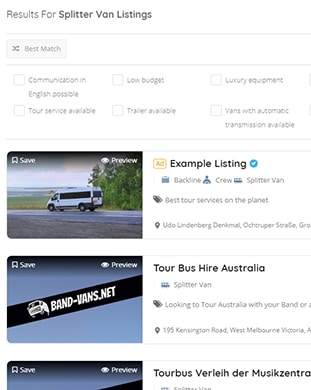

Top of Search

Your listing will appear on top of the search results (location and category related).

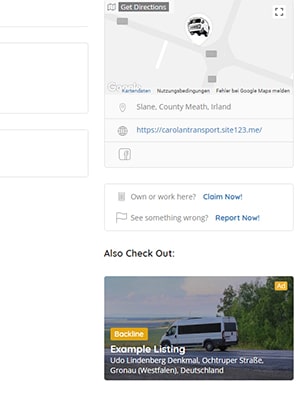

Listing Sidebar

Your listing will appear in the sidebar of other, similar listings.

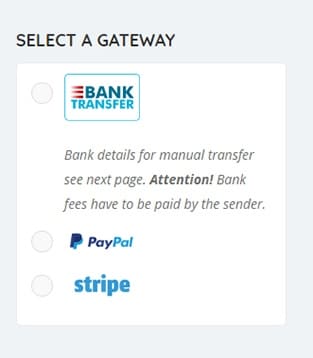

Payment options

1. PayPal

You can pay per debit or credit card, a bank account or your PayPal balance.

2. Stripe

You can also pay per credit card using Stripe.

3. Manual bank transfer

The Band-Vans.net bank account details will be shown during the checkout process. After the money has been received, you will be informed by e-mail.